Download PDF Version: Skilled Nursing Facility and Post-Acute Care 2025 Trends

Financial Risks, Investment Priorities, Care Delivery Opportunities Headline Strategic Agenda

The new year ushers in a complex blend of threats and opportunities for the post-acute care industry. Skilled nursing facilities (SNF) will need adroit execution of strategies that simultaneously promote financial health, capitalize on exciting developments in care delivery, and invest for the future.

The Skilled Nursing Facility and Post-Acute Care 2025 Trends Report is the second annual offering from Aria Care Partners, the leading provider of onsite ancillary medical services for SNFs. The report’s extensive data and analysis uncovers six high-impact, intersecting trends confronting decision-makers (Figure 1). The trends involve a formidable matrix of management concerns: workforce, insurance, technology, value orientation, personalized care, and ancillary care developments in Aria’s focal service areas of dental, vision, hearing, and podiatry. A look at the financial context that will inform decisions throughout the year precedes the trends discussion.

Dental Trends | Hearing Trends | Vision Trends | Podiatry Trends

Baseline: Managing Financial Discipline and Growth Investment

Progress was achieved in 2024 on selected SNF financial and operational metrics. Occupancy rates continued to improve from pandemic lows. Through October, hospital discharges per calendar day, a vital source of SNF referrals, were up 4% year over year.1 The overall nursing home sector saw pricing up 4.5% on an annual basis.2

Cautious optimism characterizes the healthcare outlook for 2025. A majority of executives from health plans and systems have an upbeat perspective (59%) and expect increased operating profitability (71%).3 A survey of 120 leaders that included SNF representation found 60% predicting modest financial improvement over the next two years.4

Key Financial Issues

Several market forces emerge from closer examination of the numbers:

- Wide divergence between more and less healthy organizations. A worrisome divergence in operating margins has taken hold: for 2023, 36% of SNFs had a margin of -4.0% or worse while 34% came in at 4% or better.5 This bifurcation mirrors that in hospitals. One analysis showed margins through mid-2024 of 8% to 32% for hospitals in the 60th to 95th profitability percentile as opposed to 2% to negative 19% for those beneath the 40th percentile.6

- Systemic conditions. Leading analysts see many of healthcare’s financial concerns as embedded and difficult to overcome. Moody’s views projected reimbursement increases as insufficient to cover "the steep rise in healthcare wages over the last three years.”7 Advisory Board says “structural” labor issues will create “slower throughput and reduced capacity.”8 Fitch Ratings cites a “fundamental disconnect between revenue generation and expense requirements that may be here for the long term.”9

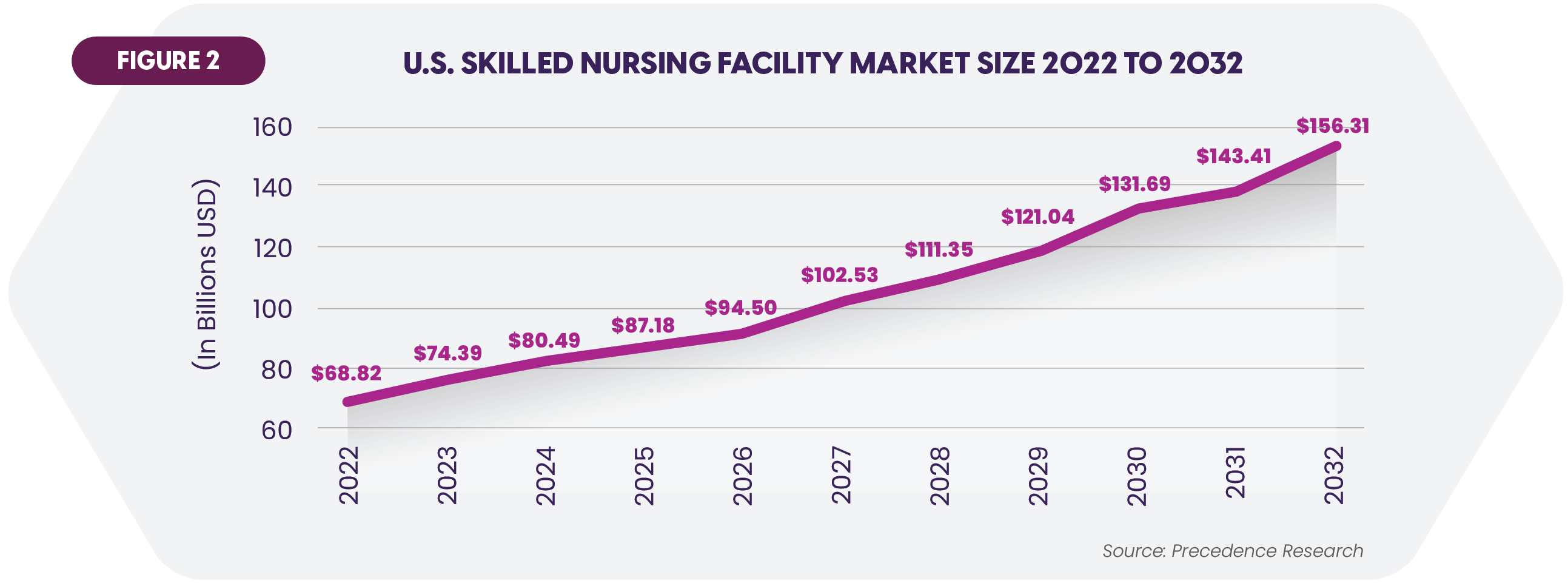

- Mixed growth outlook. The SNF market should see compound annual growth of 8.6% from 2023 to 2032, powered by the aging population (Figure 2).10 Some prognosticators envision volume declines of 2% between 2024 and 2034.11 Supply is one industry constraint. There are fewer SNF facilities than prior to the pandemic. The rural sector has been particularly hard hit, accounting for 31% percent of nursing home closures since 2020.12

Where Are SNFs Looking for Growth?

Complementing their bottom-line attention, SNFs are seeking growth from several sources:

- Diversified revenue streams. Over a third of surveyed skilled nursing administrators indicated the likelihood to add specialty services such as dialysis, memory care, and ventilator care.13

- Partnering and M&A. Some operators will pursue non-organic growth through the well-established M&A channel. Potential acquirers include health systems. Nine percent plan to acquire SNF or long-term care facilities over the coming year.14 Partnerships and joint ventures may be a viable alternative, and 45% of health systems would entertain alliances for outpatient post-acute services.15 Such affiliations can be a lifeline. Many rural hospitals that have partnered with or sold to systems have seen improved margins.16

Persistent Workforce Disruption

Stating that “SNFs still face significant workforce challenges,” Fitch Ratings notes that payrolls have dropped 7.3% since 2020 while the national labor market has risen over 5%.17 The long-term services workforce is projected to grow by 42% between 2021 and 2036, resulting in a need for over 800,000 additional people.18

Elevated turnover rates are another issue. Over half of nursing homes annually replace 50% or more of staff.19 Nationwide nursing turnover is 18.4%.20 Job satisfaction levels also suggest heightened risk. Though an improvement, 36.7% of nursing home leaders and 39.5% of nurse leaders considered quitting in the last three months, while fewer than one in three nurse leaders describe themselves as “very satisfied” with their jobs.21

Substantial consequences ensue from these statistics:

- Higher costs and lower margins. SNF wages have surged over the past several years, especially for nurses. Increases abated in 2024 but were still estimated at 3.3% to 3.5% across a range of roles.22 One study determined that homes that experienced an administrator depart saw a 1.15% operating margin decrease.23

- Reduced capacity. Staffing shortfalls inhibit optimal capacity utilization and thereby constrain SNF growth.

- Care quality. Surveys link higher turnover to lower quality and resident satisfaction metrics.24

Retention is a central effort in ameliorating the workforce problems. Compensation is a prime tool. Cross-industry analyses show that many employees are financially insecure. Pay hikes can be difficult for SNFs to accommodate. Potential lower cost options such as contributing more to retirement plans score highly with employees.25 Some organizations are also offering Earned Wage Access that permits employees to receive their wages on-demand after completion of work rather than waiting for a regular paycheck.

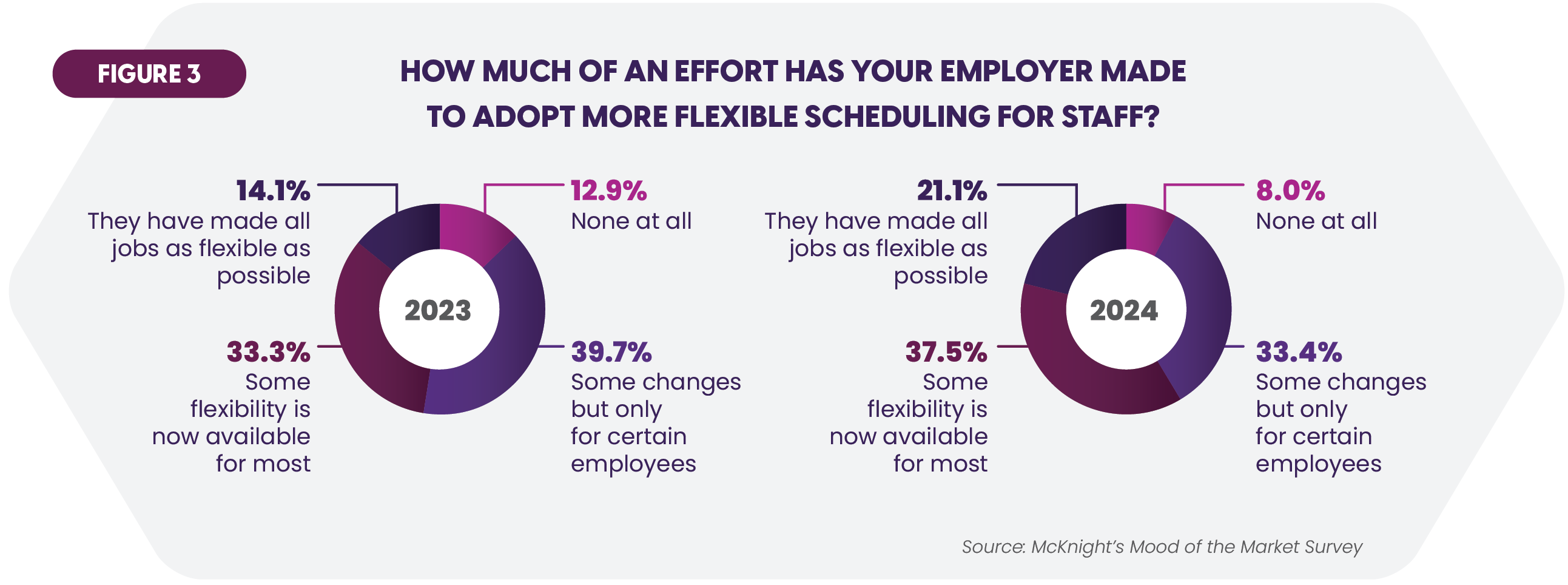

Work-life balance is another retention booster. More SNFs are responding with flexible staff scheduling for most or all of their workforces (Figure 3).26

Ongoing Commitment to Broad Range of Technologies to Transform Care and Operations

Healthcare has invested robustly in an array of technologies to improve care delivery, financial performance, and operational efficiency. A survey of providers, payers and employers found that 75% have boosted spending on digital health solutions over the past two years, and a healthy percentage intend to do so again in the next year.27 Nearly 60% of skilled nursing providers will add EHR and other technology to improve profitability.28

Investment Objectives

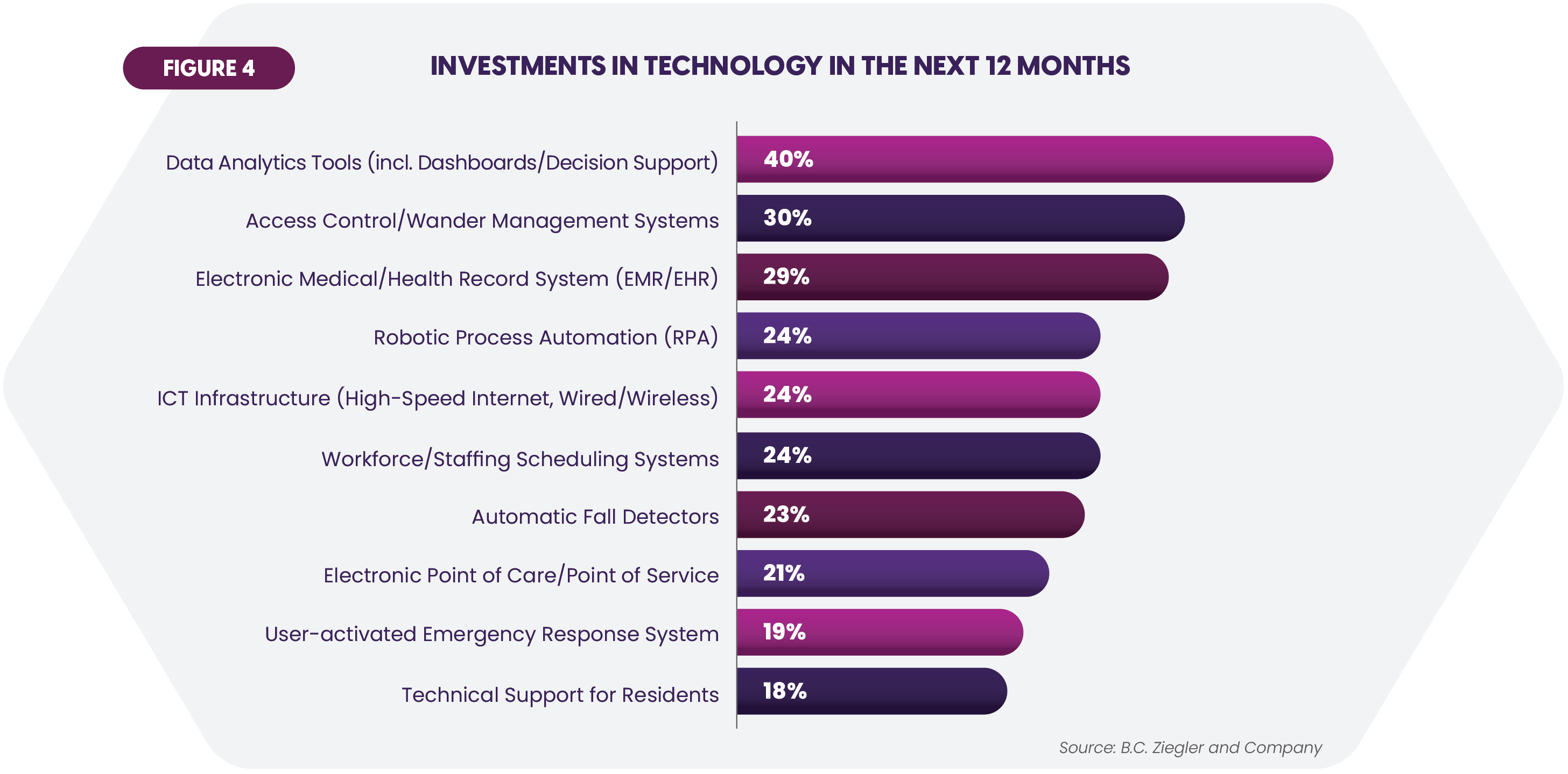

A recent poll uncovered the leading technology priorities among senior living facilities, many of which are shared by SNFs (Figure 4).29

Improved care delivery is one takeaway from the list. The SNF medical devices market, which encompasses solutions such as smart beds and remote monitoring, is slated to grow at 6.8% compounded annually between 2024 and 2030 to reach just under $2 billion.30 Fall detection systems growth is almost 8% per year.31

The list’s inclusion of Robotic Process Automation and workforce management systems underscores the desire for greater automation. Manual, paper-based operations abound in healthcare (see Figure 5 for examples).32 Analysts estimate that healthcare could save $16.4 billion by implementing fully electronic processing for a number of high-volume administrative transactions.33

The list’s inclusion of Robotic Process Automation and workforce management systems underscores the desire for greater automation. Manual, paper-based operations abound in healthcare (see Figure 5 for examples).32 Analysts estimate that healthcare could save $16.4 billion by implementing fully electronic processing for a number of high-volume administrative transactions.33

Technologies in the Spotlight

Three technologies deserve highlighting for their impact on post-acute facilities. Subsequent sections of this report will describe the application of these and other technologies within specific medical specialties.

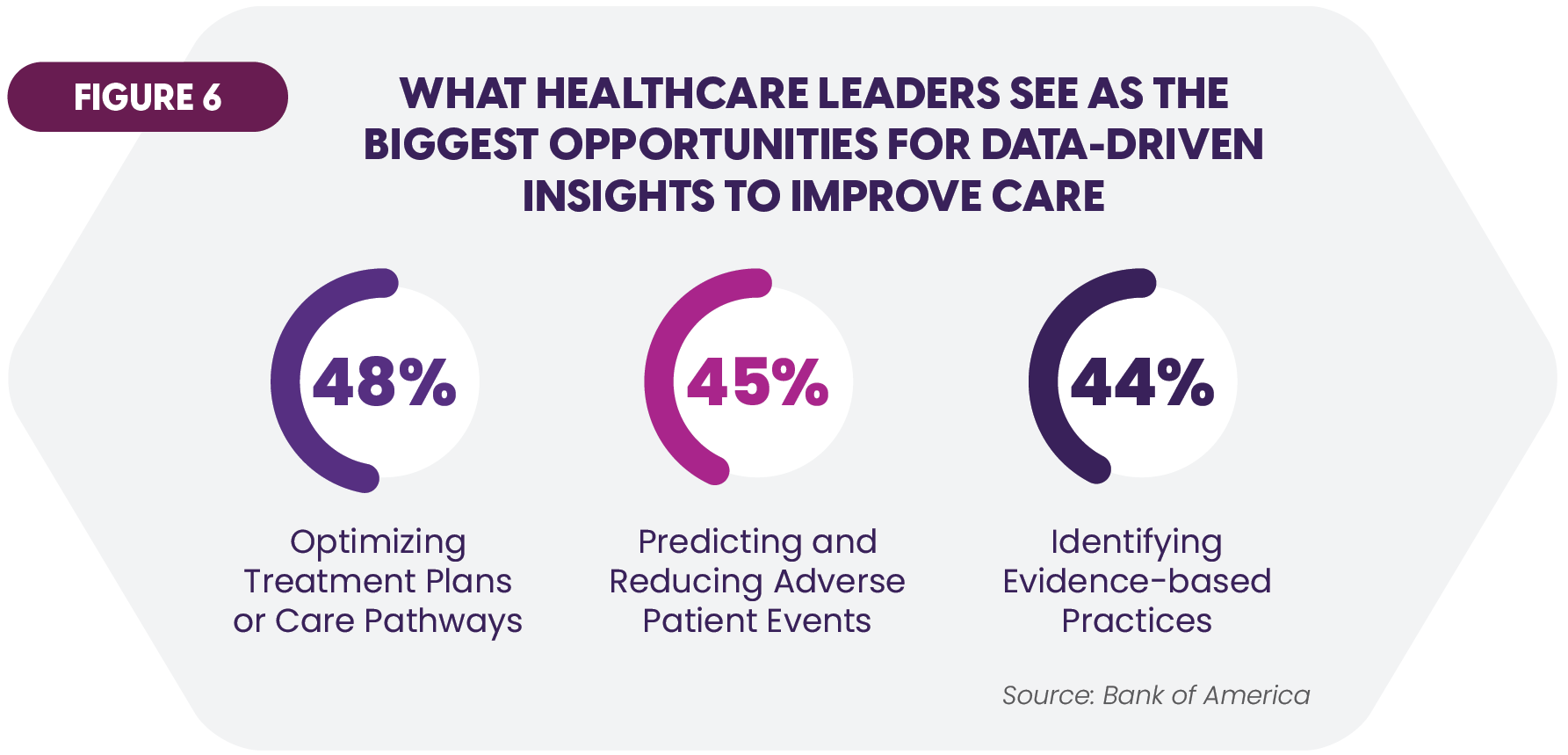

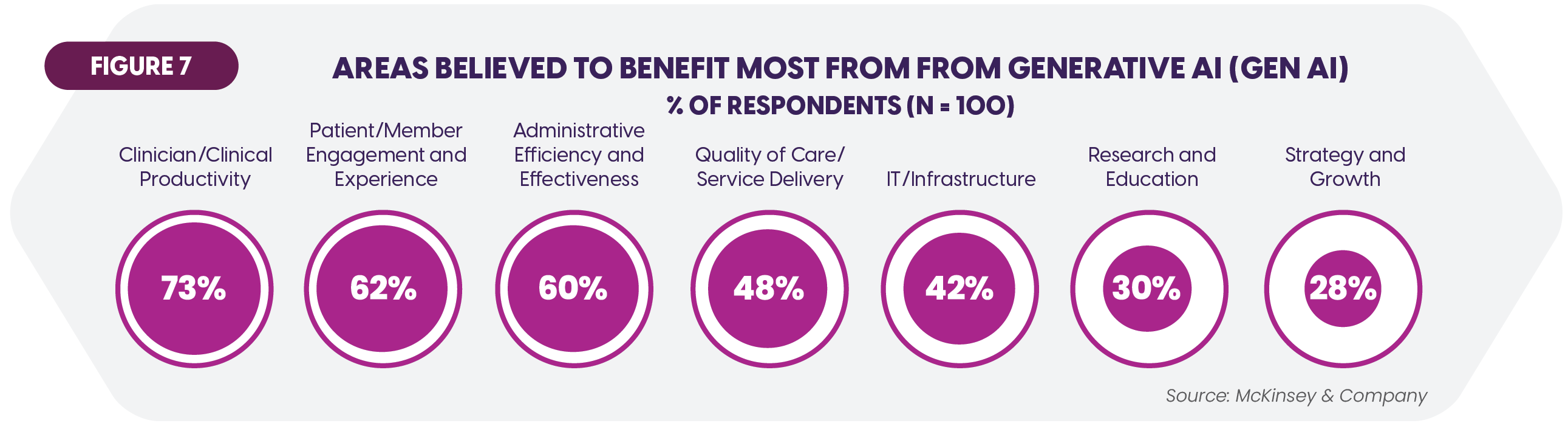

Artificial intelligence (AI) and Data Analytics. Increasingly sophisticated tools are extracting meaningful insights from healthcare’s vast stores of data. Better care is an expected outcome (Figure 6).34 Analytics are also guiding administrators in the search for cost savings and productivity gains. AI represents a force multiplier for clinical and administrative work. Usage ranges from “copilots” that augment human effort to fully autonomous “agents” that can fully replace it. Leaders view Generative AI — a form that is able to create new content — as offering rich and varied benefits (Figure 7).35

Artificial intelligence (AI) and Data Analytics. Increasingly sophisticated tools are extracting meaningful insights from healthcare’s vast stores of data. Better care is an expected outcome (Figure 6).34 Analytics are also guiding administrators in the search for cost savings and productivity gains. AI represents a force multiplier for clinical and administrative work. Usage ranges from “copilots” that augment human effort to fully autonomous “agents” that can fully replace it. Leaders view Generative AI — a form that is able to create new content — as offering rich and varied benefits (Figure 7).35

AI’s labor impact may be dramatic. Fifteen percent of current healthcare workforce hours might be subject to automation by 2030.36 Clinicians productivity is being increased through “ambient clinical documentation” that fuses AI and speech recognition to produce draft encounter notes automatically.

- Cybersecurity. Cyberattacks plague the entire healthcare sector. Consider a few statistics:

- Attacks averaged 2,434 per week for just the third quarter of 2024, up 81% over the same 2023 period.37

- Healthcare tops all industries for costliest data breaches, with the average incident incurring $9.77 million.38

- SNFs can certainly be targets, and they must also monitor the security of their partners and suppliers. Over 8 in 10 of the largest data breaches in recent years have involved third-party providers or non-hospital health care organizations.39

Preparedness is a concern. Fifty-three percent of surveyed healthcare and life sciences organizations lack sufficient financial resources to manage security threats.40

- Mobile apps. The ubiquity of smartphones and mobile devices is driving increasing deployment of patient engagement apps. A significant percentage (71%) of adults over age 50 is considered receptive to using health and wellness apps.41

Barriers to adoption

Technology will be transformative for SNF communities. The strategic and tactical challenges to realizing the benefits are substantial and will require creativity and partnering to overcome them. Heavily cited barriers include budget limitations, legacy systems, workforce readiness for new technologies, and data access/quality issues.42

Health Insurance Changes Bring Financial Uncertainties

Several health insurance trends carry significant implications for SNF finances. Key issues have emerged in Affordable Care Act marketplaces (ACA), Medicare Advantage (MA), and Medicaid.

ACA

A record 23 million people acquired coverage through the Affordable Care Act Marketplace in 2023.43 Most have relied on temporary enhanced subsidies to help fund the premiums. Subsidized enrollment has increased from 9.6 million to 19.7 over the past four years.44 The program terminates at the close of 2025, raising the specter of substantial coverage loss. CMS forecasts a drop next year in direct-purchase enrollment of 7.3 million people from subsidy removal.45 If lost coverage induces care deferral or avoidance, all healthcare organizations will be financially affected.

The fate of the program permitting Deferred Action for Childhood Arrivals (DACA) recipients to enroll through ACA marketplaces beginning in late 2024 is also uncertain. Some 100,000 new enrollees have been projected.46

Medicare Advantage

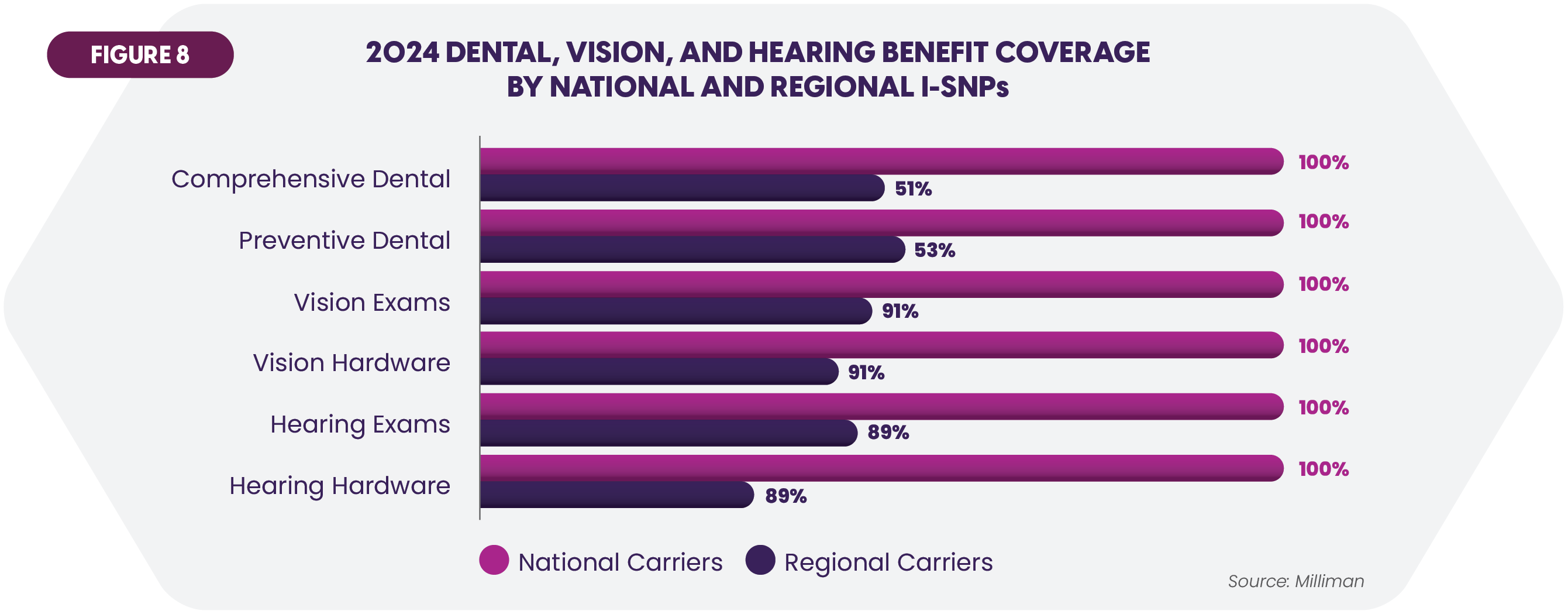

MA remains an important income source for post-acute facilities. In 2024, nearly 33 million people were enrolled. Special Needs Plans (SNPs) are a fast-growing category within MA. I-SNPs are designed for beneficiaries needing long-term and SNF care, and the 177 plans in 2024 included strong ancillary services coverage (Figure 8).47

Another variant is D-SNPs serving individuals enrolled in both Medicare and Medicaid. This program’s enrollment has doubled over the past four years.

SNFs are contending with several problems associated with MA. First, studies have documented reduced use of post-acute services and lower revenue and margins relative to traditional Medicare.48,49 Second, MA has been burdensome. Navigating prior authorization processes and addressing coverage denials are major factors. An assessment of claims involving hospital discharge to post-acute care revealed that more than 20% were denied by private insurers.50 MA plans had the highest denial rate. In 2022, the major insurers denied prior authorization requests for post-acute care at rates exceeding their overall denial levels by anywhere from three to sixteen times.51

Medicaid

Medicaid reached 91.2 million beneficiaries in 2023 propelled by the COVID-era continuous enrollment requirement. This program has expired and is projected to reduce Medicaid enrollment to 79.4 million in 2025.52 Many analysts foresee further reductions. Cutbacks in federal funding would jeopardize benefits for over three million adults in nine states that have laws triggering rapid termination of their Medicaid expansions in such scenarios.53

Another growing program that could incur funding cuts is State-Directed Medicaid Payments (SDP). These incentives promote provider engagement in Medicaid managed care arrangements. Over 75% of states now participate across 302 approved plans in the 2023-2024 time frame.54

More Progress Needed in Migration to Value-Oriented Models

Notwithstanding a myriad of initiatives promulgated over many years, success in replacing fee-for-service reimbursement with a value-based care (VBC) paradigm has proven elusive. A 2023 analysis placed the total share of healthcare payments tied to the VBC “gold standard” of assuming downside provider risk at 28.5% (43% for MA).55 Under 30% of organizations see alignment between their VBC aspirations and their organizational capabilities, according to a survey.56

SNFs are increasingly value-oriented, and the SNF Value Based Purchasing Program (VBP) remains important. The financial impact can be substantial. Recent administrative changes are projected to reduce total SNF payments by $188 million for FY 2025.57

Future changes

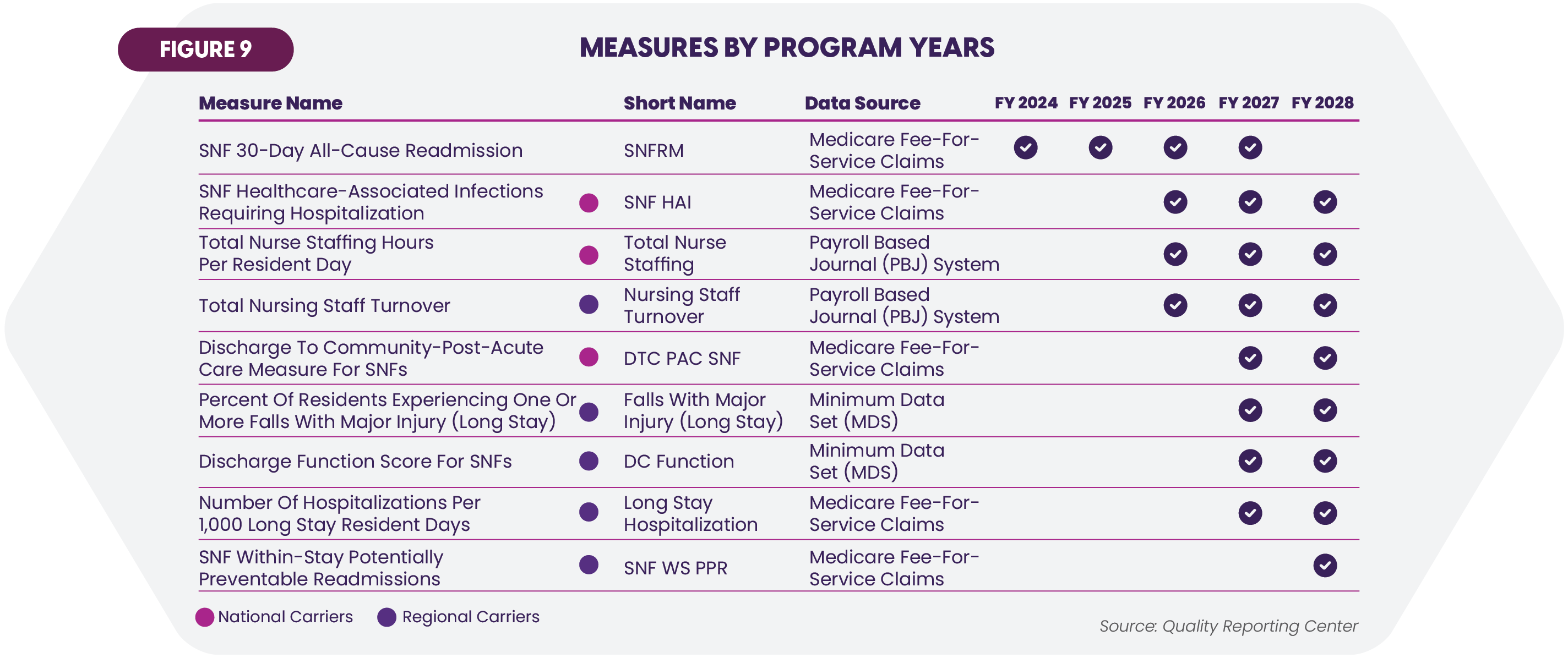

This year’s solo metric for determining VBP incentives is the SNF 30-Day All-Cause Readmission measure. The program years 2026 through 2028 will see several new quality measures (Figure 9).58

Improving care transitions

One acknowledged avenue to value realization is integrated care. Transitions between hospitals and post-acute facilities have long been sub-optimal. Better communications are vital to improve these transitions. SNF providers report frequent mismatched transfer forms and discharge summaries as well as missing or inconsistent medication lists, instructions for care, and patient histories. Communication also suffers from understanding gaps: “Several hospital providers shared that they had never been to a SNF and only had a vague sense of the services available there.”59

One study of common transition strategies found the best outcomes were achieved through a combination of promoting trust among patients while at the hospital, communicating to them in plain language, and employing coordination activities.60

Rising Demand for Personalized, Age-Appropriate Care

Aria Care Partners’ experience corroborates the major value from providing care that is tailored to the singular needs of older people and is personalized to each resident. Demand for such care is accelerating, stemming from multiple powerful sources. Patients and residents increasingly bring a “retail consumer” mindset to healthcare that favors strong responsiveness to individual requirements. At the same time, new technologies, pharmaceuticals, and treatments are pointing the way to highly customizable care.

What older patients and residents seek

The literature continues to refine the picture of what today’s older adults want in their healthcare. They possess a “three-dimensional view of safety” that encompasses preventing physical harm, preventing emotional harm, and providing a safe environment.61 They strongly believe that “providers should be trained on the unique health issues of older adults,” a distinct shortcoming as fewer than one percent of physicians are geriatric specialists and just 10% of medical schools require geriatric rotations.62 Two-thirds of surveyed individuals placed top importance to having a provider who “listens to and respects me.”63

Age-Friendly care

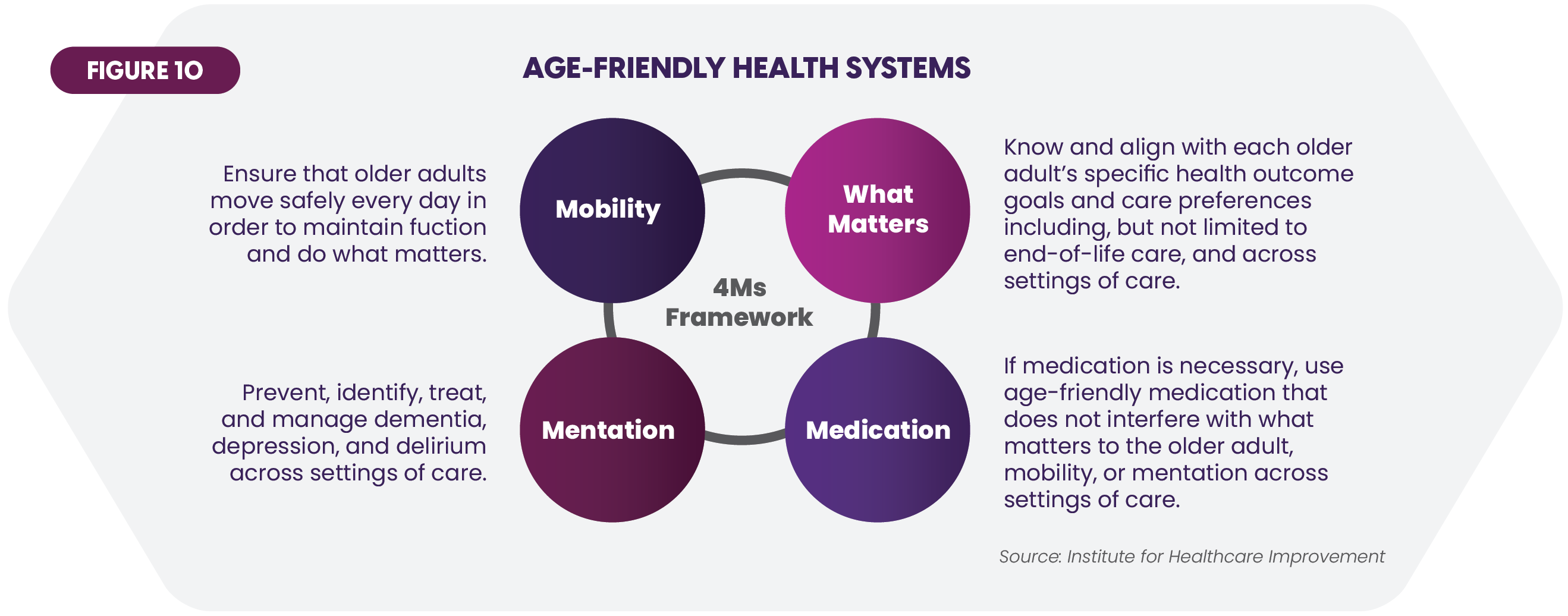

Several initiatives offer counsel on how to fulfill these requirements. The 4Ms of Age-Friendly Care framework, developed by several foundations and associations, delineates key actions that promote reduced readmissions, decreased length of stay, and improved outcomes (Figure 10).64 Some 4,000 care sites, including post-acute, have been designated age-friendly to date.

Growing Demand and Dynamic Developments in Leading Ancillary Care Specialties Spell Opportunities

Ancillary care offers SNFs opportunities for growth and delivery of care that is comprehensive, value-oriented, and personalized. Aria Care Partners participates in four vibrant service areas: dental, hearing, vision, and podiatry. This section examines important trends and issues as well as emerging technology developments in each area.

Dental: Care Issues and Trends

Oral health is an important concern for SNFs. Thirteen percent of those over 65 have untreated tooth decay.65 Almost two-thirds have moderate to severe periodontal disease.66 Many have missing teeth.

Dental care is even more crucial given the correlation between oral problems and chronic conditions ranging from autoimmune diseases to obesity to cardiovascular disease. Three connections call for particular surveillance by SNFs:

- Diabetes. People with diabetes have a 2–3-fold greater risk for periodontitis and a higher risk of tooth decay due to dry mouth (xerostomia) caused by high blood sugar levels.67

- Chronic kidney disease (CKD). Periodontal disease heightens systemic inflammation that is known to contribute to CKD progression.68

- Mental health. The nexus between oral and mental health is increasingly clear. About 1 in 5 adults say oral health issues caused them to become anxious, lose sleep, or feel embarrassed about their appearance, while 15% indicated sadness and mood drop.69

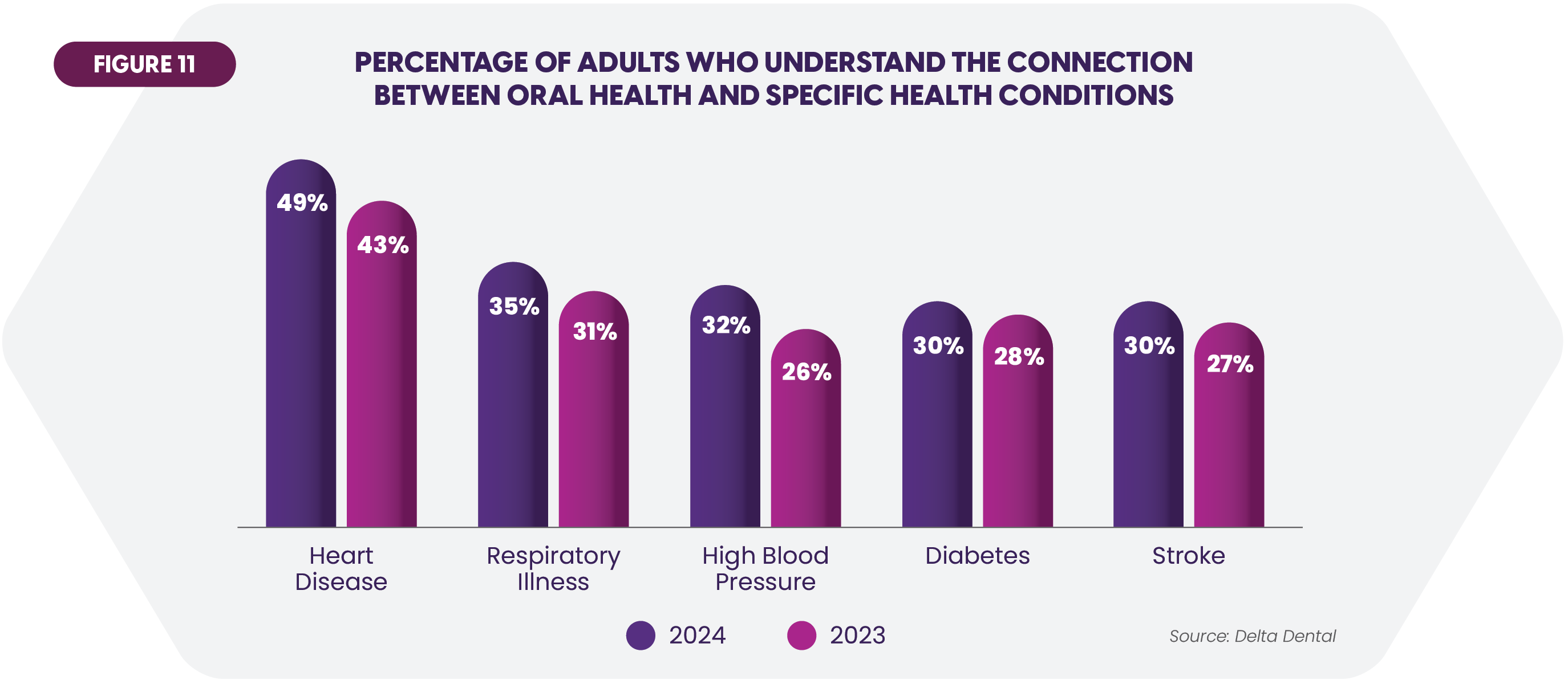

Recognition of these correlations is increasing, fostering receptivity to dental care in the SNF (Figure 11).

Gaps in care pose risks for many residents. The elapsed time from the last dental visit can be considerable: two years for 36% of respondents in a recent study.70 Affordability is a barrier. Twenty percent of American seniors did not visit a dentist in the past twelve months due to cost.71 Insurance coverage is far from universal. Nearly two-thirds of adults currently carry dental insurance.72 Medicaid dental benefits vary across the states. Dentist participation is generally low since Medicaid Fee-for-Service reimbursement for 2024 is 30% of average dentist charges for adults.73

Dental Technology Trends

- MRI Imaging. The University of Minnesota recently installed the first American MRI unit dedicated to dental imaging. Ability to view soft tissue as well as bones and teeth enables better identification of inflammatory changes, lesions, and other problems.74

- AI. One analysis summarized a range of dental applications that will benefit from AI enhancements.75

- Diagnostic imaging. AI can greatly enhance image interpretation.

- Operative dentistry. AI’s detection of tooth decay, root fractures, and gum disease is more precise than with X-rays and is capable of spotting early-stage problems.

- Orthodontics. High-precision measurements, data-driven treatment strategies and ability to predict results promise real advancement in this area.

- 3D Printing. An intraoral scanner, computer-aided design software, and a “printer” that builds objects by additively layering material combine to create dentures, crowns and bridges. The 3-D output can be highly customized to each individual. One manufacturer notes that “accurate anatomical replicas of a patient’s mouth and jaws can be made” as can precise surgical guides to make oral drilling and cutting easier.76

- Smart toothbrushes. Sensors in a toothbrush feed data to an app that guides users to perform more thorough and proper oral hygiene. The smart toothbrush market is growing at a 10% compound annual rate through 2036.77

Hearing: Care Issues and Trends

Thirty percent of adults between 65 and 74 exhibit hearing loss, jumping to half of those over 75.78 A study of individuals age 71 and up determined that 28% had moderate to severe impairment.79 Sixteen million people seek medical attention for tinnitus annually.80

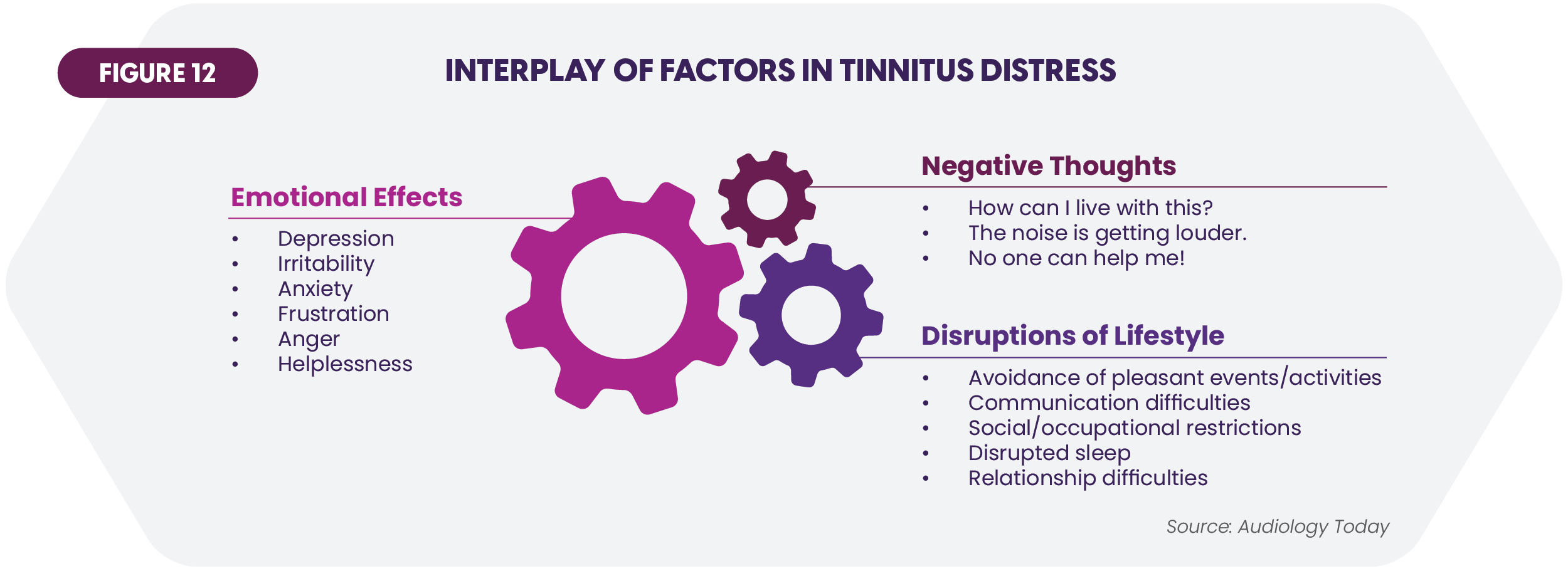

Diabetes can cause ear damage. Hearing loss is double the level in those with diabetes versus non-diabetics of the same age, and people with prediabetes exhibit a 30% higher rate of hearing loss than those with normal blood sugar levels.81 Studies likewise connect hearing and emotional health. Respondents to one survey said hearing loss makes them feel stressed (54%), depressed (52%), anxious (48%), worried (45%), sad (40%) and lonely (32%).82 A model crafted to display the reinforcing emotional effects of tinnitus is relevant to all sources of serious hearing impairment (Figure 12).83

Audiology professionals confront significant complications in care delivery. Two often seen in the SNF environment:

- Hearing aid stigma. Only 29% of people with hearing loss use hearing aids. The figures are higher for those with moderate (45%) or severe (68%) loss, but still far from universal.84 Polls reveal that nearly half of respondents believe that a stigma still attaches to hearing aids, with 66% registering greater willingness to wear them if not visible.85

- Communication gaps. Some individuals fail to tell caregivers about their hearing impairments. For others, hearing problems create difficulty communicating with medical professionals. Medicare beneficiaries who reported such trouble had 32% greater odds of hospital readmission on average.86 An interesting analysis of encounters showed the importance of strong communication skills. In half the appointments regarding hearing aid recommendations, patients expressed negative feelings. However, audiologists “missed opportunities to build relationships” by failing to address the concerns or impeded adoption of hearing aids by responding with complex language.87

Hearing Technology Trends

- Digital hearing aids. Greater functionality and quality are resulting from wireless connectivity to smartphones and other devices, noise cancellation, user customization, and reduced size. Perhaps the most interesting recent development is introduction of Apple’s latest AirPods devices (Figure 13). The company states that this product is designed to deliver “active Hearing Protection, a scientifically validated Hearing Test, and a clinical-grade Hearing Aid feature.” Given the wide user acceptance of ear buds, solutions such as this may overcome much of the resistance to hearing aids.

- Device compatibility mandates. In October, the Federal Communications Commission issued rules requiring that all mobile handsets, such as smartphones, be compatible with hearing aids, including better Bluetooth connectivity and new volume control benchmarks.88

- AI and Machine Learning. Algorithms will analyze individual hearing parameters and preferences as well as the listener’s environment to produce highly personalized settings for hearing devices. AI will also enable automatic real-time adjustments to optimize hearing in a given situation as well as enhance diagnostic and clinical support for audiologists.

Vision: Care Issues and Trends

Vision loss is defined as full blindness or trouble seeing even with glasses. It afflicts over 13 million older Americans.89 SNF residents are likely to present with some vision issues. One small study found that vision impairment and blindness affected 63.8% of nursing home residents.90 Prominent issues among the elderly are age-related macular degeneration (196 million people globally) and glaucoma (76 million).91

Diabetes is once again a principal concern. Diabetic retinopathy affects blood vessels in the retina and can lead to vision loss and blindness. More than half of diabetics will develop it.92 Fall risk is likewise top of mind. Vision impairment has been linked to elevated incidence of falls as well as greater fear of falling.93

Vision problems can engender anxiety, a feeling of lost independence, and isolation from others. Underscoring the mental health connection, the Lancet Commission in 2024 cited “new compelling evidence” in adding untreated vision loss to its list of risk factors for dementia.94

As with dental and hearing care, many people avoid eye exams. One analysis showed that 10% had not had one in over three years.95 Echoing a consistent theme of this report, affordability is an issue. For example, an estimated 6.5 million Medicaid enrollees live in states that lack routine eye exam coverage and 14.6 million in states that do not pay for glasses.96

Vision Technology Trends

- Assistive technology (AT). This category encompasses screen readers, navigational canes, and other devices helping the vision impaired perform essential functions. AT is increasingly being integrated into smartphones. Further AT expansion is needed, with a “pressing issue being websites that are not compatible with screen readers” and items such as price tags, and clothing labels.97

- Smart glasses and digital lenses. “Computerized eyewear” continues to see enhancements such as real-time navigation guidance, interactive communications features bolstered by fast 5G wireless and augmented reality, and gesture recognition. Advances in digital lenses are allowing precise user personalization. New materials are creating lighter weight and more eco-friendly frames. The global smart glasses market is said to be growing at a substantial 29.4% compound annual rate through 2030 to reach over $4 billion.98

- AI. As one example, Google has created the Automated Retinal Disease Assessment tool based on an AI model trained on over 100,000 retinal scans. This program has demonstrated high accuracy in detecting diabetic retinopathy. AI offers hope of spotting chronic problems at much earlier stages than presently.

- LASIK. Advancements in LASIK surgery include “ultrafast lasers” to improve precision and safety, smart systems to enhance surgical precision, and AI-based LASIK capable of predicting post-operative outcomes.99

Podiatry: Care Issues and Trends

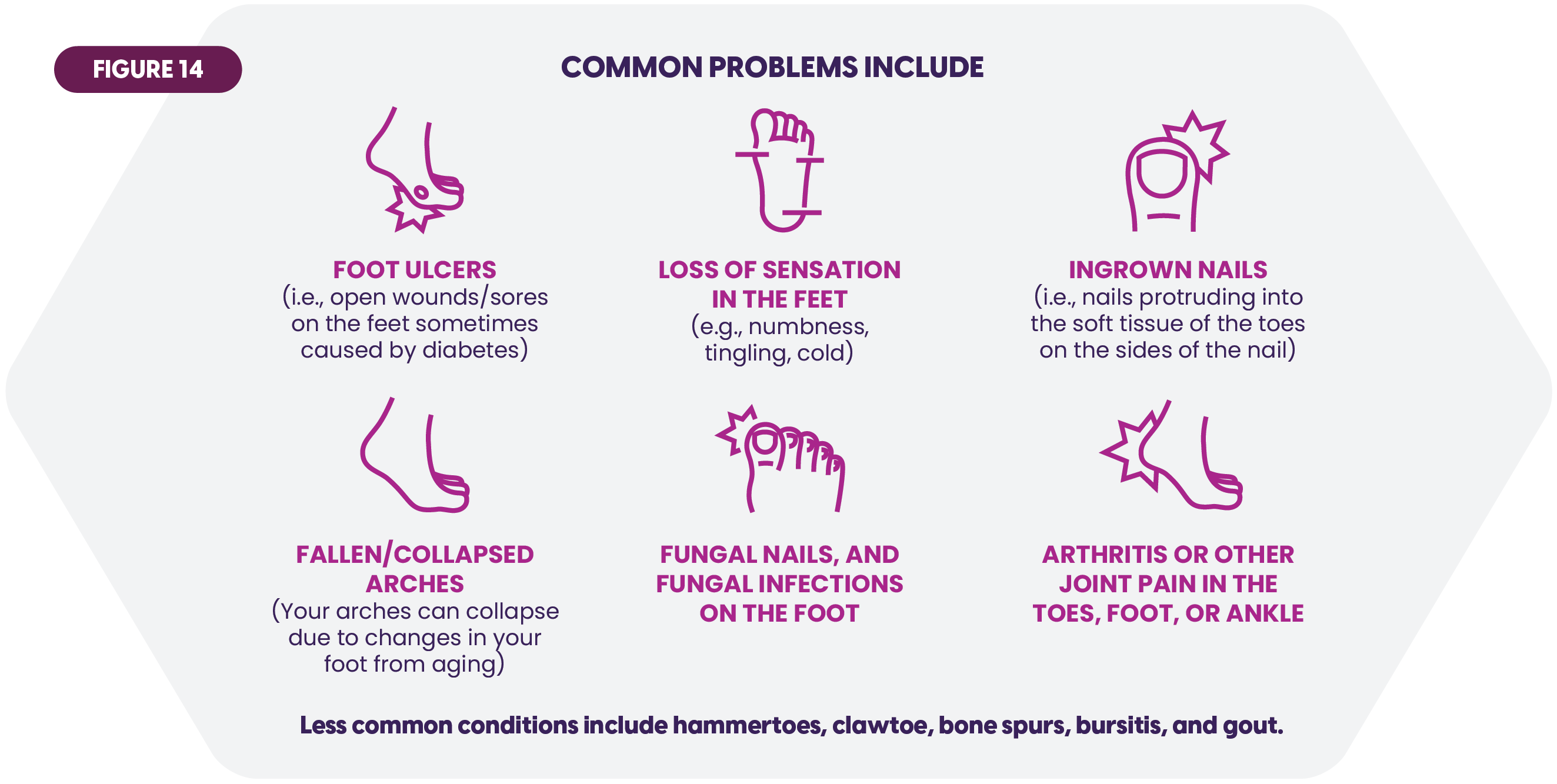

Figure 14 captures several lower extremity medical problems seen frequently in SNF residents. A few statistics convey the extent:

- One-third of older adults have foot pain, stiffness, or aching feet.100

- As many as 87% of older adults experience foot problems, often attributable to vision or dexterity deficits.101

- Footwear is a problem. One study calculated that between 63% and 72% of participants wear improperly fitting shoes, and also found association between this footwear and foot pain and disorders.102

Foot problems heighten several risks to which SNFs must be attentive:

- Wounds. Aging feet are prone to developing open wounds. Peripheral Arterial Disease (PAD) constricts blood flow to the legs and can lead to non-healing ulcers on the feet and lower legs that rapidly develop complications. Over 20% of those age 80 and up are diagnosed with PAD.103

- Falls. Between 30% and 40% of adults over 65 will fall, rising to 50% for those over 80.104 From pain to various deformities, a host of foot and ankle problems can induce debilitating falls.

- Mental health. Studies have linked mental health with various leg and foot problems that restrict activities and impact self-esteem.105,106

An effective SNF foot care program includes wound identification and treatment protocols, analysis of gait and motion clues, and other regular checkups. It also involves advice on proper footwear, an issue often overlooked (Figure 15).107

Podiatry Technology Trends

- 3D Scanning and Printing. Additive manufacturing using advanced digital scanning continues to produce customized orthotics. AI promises to add new levels of precision and capability. The market for custom foot orthotics is large and growing steadily at almost 8% yearly through 2031.108 The 3D Printing process is also being applied to devices such as ankle plates to create anatomic contours unachievable by conventional milling.109

- Smart Insoles and Socks. Podiatrists can guide residents on the latest smart insoles, socks, and other wearables (Figure 16). Embedded sensors permit remote monitoring of gait, temperature and other variables to aid in diagnosis of a variety of foot problems. For example, gauging temperature changes in the feet of diabetics aids in preventing ulcers. Smart insoles also help deter falls by tracking mobility. The global smart insole market is rising at almost 10% compounded annually to $461 million in 2033.110

- Laser and minimally invasive treatments. Laser therapy has shown efficacy as a drug-free alternative to accelerate wound healing.111 Lasers are also being safely used to remove stubborn warts, ingrown toenails at the root, and other conditions. Developments in this area include portable lasers and higher-accuracy imaging. Podiatry lasers are already a $1.5 billion market.112 Minimally invasive surgery is also growing in areas such as bunion removal, while microwave therapy supplants the often-painful traditional methods of wart destruction.

Conclusion

The new year brings a full menu of priorities for SNF leadership and stakeholders. Close monitoring of the trends discussed in this report is essential. Financial discipline remains paramount, but it will be influenced by the many risks and rewards evident in workforce management, technology investment, adapting to insurance market changes, and value-based and age-friendly care. Strong ancillary care is an important platform given the growing need, interaction with chronic care demands, and exciting developments in the various specialties. Aria Care Partners will continue to partner with communities to help them understand these directions and deliver comprehensive care. Success awaits SNFs willing to harness industry change through steady commitment and flexible action.

Home Page

Home Page Home Page

Home Page

Share to Twitter

Share to Twitter

Share to Linked In

Share to Linked In